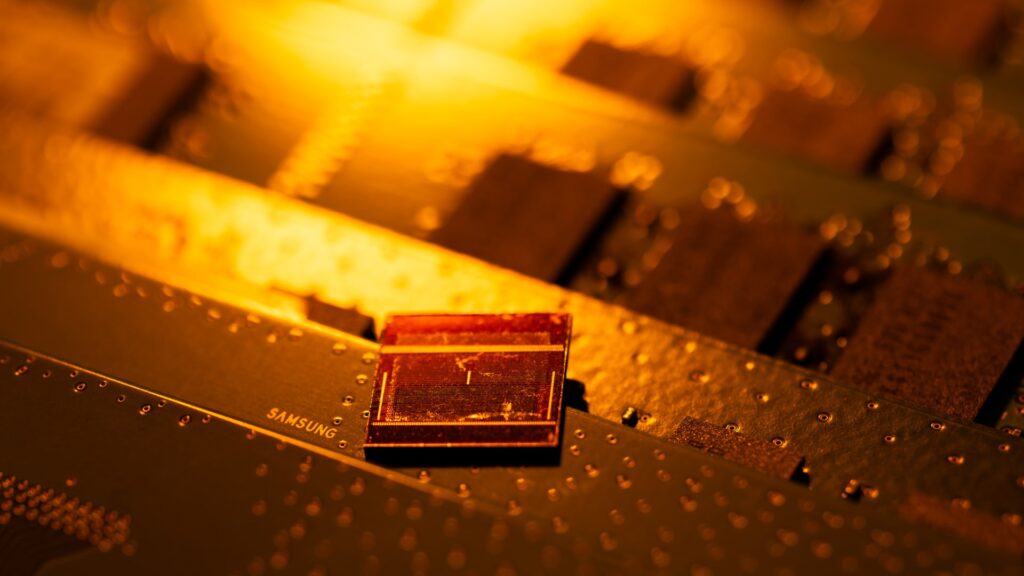

High-performance memory chips are likely to remain in tight supply this year due to explosive demand for AI technology, leading to a shortage of these premium chips, as per analysts. Companies such as SK Hynix and Micron, two of the major memory chip suppliers globally, have already exhausted their high-bandwidth memory chip stock for 2024, and supplies for 2025 are also nearly sold out, stated the firms. The demand for AI chipsets has significantly boosted the high-end memory chip market, benefiting companies like Samsung Electronics and SK Hynix, the world’s top two memory chip manufacturers. SK Hynix, which already supplies chips to Nvidia, is now reportedly being considered by Samsung as a potential supplier to meet the growing demand.

The role of high-performance memory chips is crucial in the training of large language models (LLMs) such as OpenAI’s ChatGPT, which has driven the rapid adoption of AI technology. These chips are essential for LLMs to memorize past conversations and user preferences to generate human-like responses to queries. Due to the complex manufacturing process and challenges in ramping up production, shortages of these memory chips are expected to persist through 2024 and into much of 2025, noted William Bailey, a director at Nasdaq IR Intelligence. The production cycle of HBM chips is longer compared to DDR5 memory chips commonly found in personal computers and servers, according to market intelligence firm TrendForce.

To address the increasing demand, SK Hynix is planning to enhance its production capacity by investing in advanced packaging facilities in Indiana, U.S., as well as in the M15X fab in Cheongju and the Yongin semiconductor cluster in South Korea. Samsung, during its first-quarter earnings call in April, stated that its HBM bit supply in 2024 had expanded significantly compared to the previous year. The company confirmed ongoing discussions with customers regarding committed supplies for 2025 and plans to double or more than double its supply every year. In contrast, Micron did not respond to requests for comments on the situation.

Intense competition

Major tech players like Microsoft, Amazon, and Google are investing billions to develop their own LLMs to stay competitive, which drives the demand for AI chips. Companies such as Meta and Microsoft have indicated their intentions to continue investing in AI infrastructure, leading to substantial purchases of AI chips, including HBM, at least through 2024. This intense competition among chipmakers to produce advanced memory chips to cater to the AI boom is evident in the industry.

Aggressive efforts are being made by chip manufacturers to capture a significant share of the market amid the AI technology surge. SK Hynix announced its plans to commence mass production of its latest 12-layer HBM3E chips in the third quarter, while Samsung Electronics aims to do the same within the second quarter, having been the first to ship samples of the latest chip in the industry. With Samsung leading in the 12-layer HBM3E sampling process, there is a possibility for the company to gain a majority share by the end of 2024 and throughout 2025, according to industry experts like SK Kim, an executive director and analyst at Daiwa Securities.

![[Galaxy Presentation 2024] A Fresh Period of Galaxy Artificial Intelligence Emerges at the Louvre in Paris – Samsung Global News Hub Samsung-Mobile-Galaxy-Unpacked-2024-Sketch_thumb728.jpg](https://dvd.gr/wp-content/uploads/2024/07/Samsung-Mobile-Galaxy-Unpacked-2024-Sketch_thumb728-150x150.jpg)