Intel’s stock took a hit as the company disclosed a staggering $7 billion operating loss in its foundry business for the year 2023. This revelation, made in a SEC filing, caused Intel’s shares to drop by 4% during extended trading on Tuesday. The substantial magnitude of this loss is in stark contrast to the $5.2 billion operating loss reported in 2022, despite lower sales figures of $18.9 billion compared to $25.7 billion the previous year.

Previously undisclosed, this financial breakdown sheds light on the revenue generated by Intel’s foundry business. Unlike its competitors like Nvidia and AMD, who outsource chip manufacturing to Asian foundries, Intel has traditionally handled both chip design and manufacturing in-house. CEO Patrick Gelsinger has been championing a strategy where Intel would not only produce its own processors but also venture into manufacturing chips for other companies.

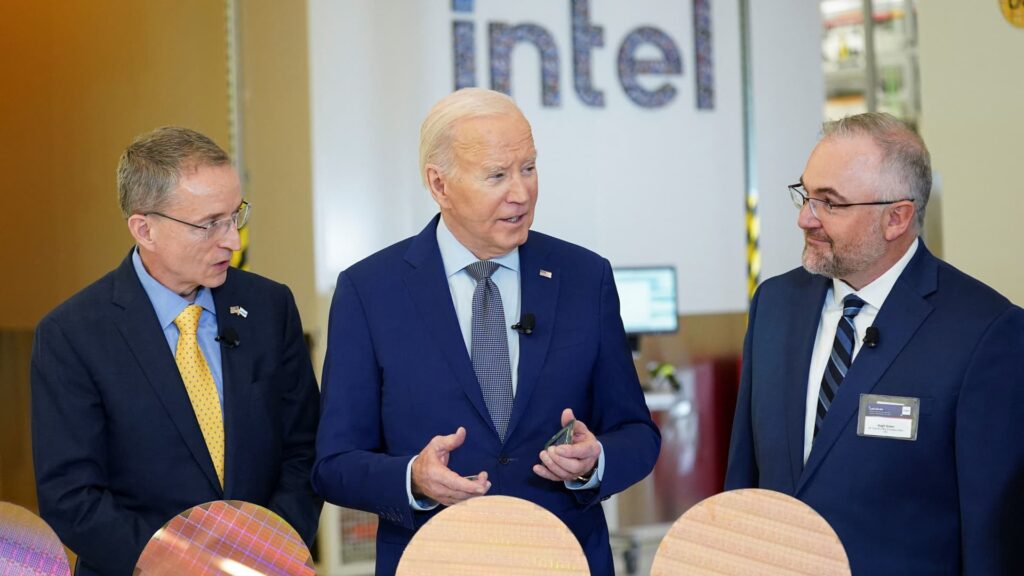

Intel’s transition to an external foundry model has been met with investor interest, culminating in nearly $20 billion in CHIPS Act funding. The company’s restructuring efforts have led to the formation of a new Products division, emphasizing the separation of costs associated with foundry operations. Despite challenges, Intel remains committed to profitability, with expectations to break even by 2030 after a projected peak in losses in 2024.

Commenting on the situation, Gelsinger expressed confidence in Intel Foundry’s future earnings potential, attributing the current losses to past decisions and delays in technology adoption. He reiterated Intel’s commitment to drive growth through its foundry business and highlighted key partnerships, such as with Microsoft, to bolster revenue streams.

The long-term success of Intel’s foundry business hinges on strategic investments and operational efficiencies to navigate the competitive semiconductor landscape. While the $7 billion loss represents a significant setback, Intel remains optimistic about its prospects for growth and financial sustainability in the coming years.