Microsoft spotlights cloud triumph from Y Combinator firms

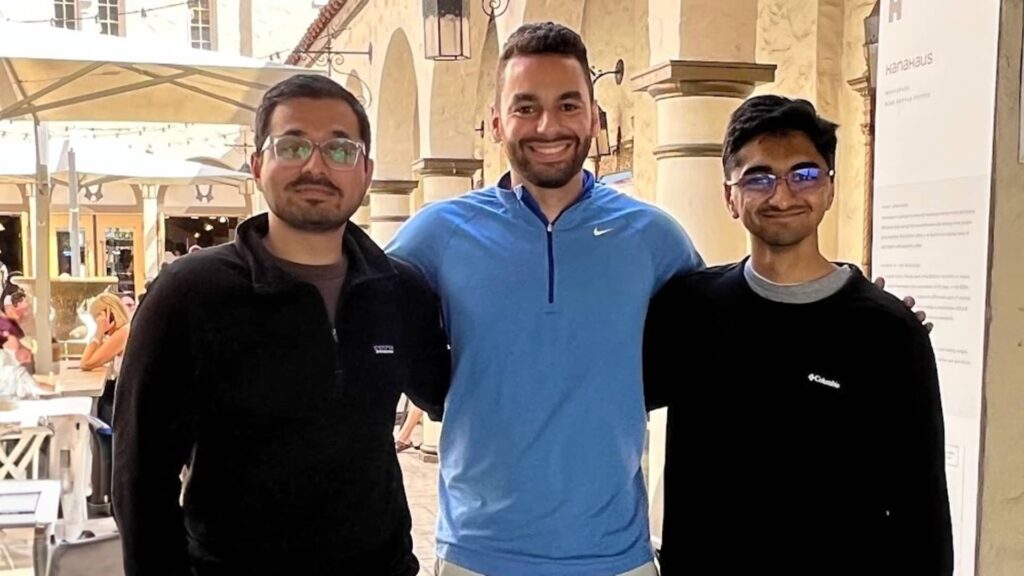

The creators of EzDubs – Amrutavarsh Kinagi (left), Kareem Nassar, and Padmanabhan Krishnamurthy – are captured in a photograph in Palo Alto, California, in August 2023.

EzDubs, a firm specializing in language-translation technology, commenced operations in a manner typical of many tech startups. It began utilizing public clouds from Amazon and Google.

Subsequent to EzDubs’ participation in the Y Combinator startup program last year, the company swiftly adapted, incorporating Microsoft’s cloud services. This decision was influenced by a unique partnership through which Y Combinator companies could access $350,000 worth of credits on Microsoft Azure.

The co-founder of EzDubs, Padmanabhan Krishnamurthy, described it as a “welcome surprise.” The credits proved especially beneficial due to Microsoft’s substantial investments in artificial intelligence developments and its hosting of numerous projects utilizing their extensive language models (LLMs).

Utilizing Azure, EzDubs secured access to high-performance graphics processing units (GPUs) essential for advanced AI model training, a capability unmatched by other cloud providers.

“It was an obvious choice,” stated Krishnamurthy, who established the company in 2022 amidst the rise of generative AI. “It was exactly what we needed, featuring GPU capabilities that were unparalleled.”

EzDubs’ experience is echoed in various forms by startups in the AI sector. While Amazon Web Services maintains its dominance in cloud infrastructure and Google retains popularity among firms leveraging multiple cloud platforms, Microsoft’s AI capabilities are positioning it favorably, particularly with startups.

In Amazon’s recent second-quarter financial report, the company noted a 19% revenue increase for AWS compared to Microsoft’s 29% growth over the same period, which also includes revenue from other cloud services additional to Azure.

AWS was the first cloud provider to offer credits to fledgling companies, aiming to cultivate loyalty among them during the credit period and transition them into significant clients. AWS’ Activate initiative commenced in 2013 following the launch of key EC2 (compute) and S3 (storage) services in 2006, solidifying Amazon’s dominance in the public cloud sector.

Microsoft’s access to robust GPU clusters, coupled with its extensive history as a ubiquitous enterprise technology provider, is altering the competitive landscape. Financial considerations also play a crucial role.

Last November, Microsoft inked a partnership with Y Combinator – renowned for spawning Dropbox, Airbnb, Stripe, and other firms – offering $350,000 in credits to startups entering the accelerator. Startups in select other programs like the Alchemist Accelerator and Alt Capital’s Generate are also eligible.

In April, Amazon followed suit, announcing $500,000 in credits to Y Combinator companies, comprising $200,000 in cloud credits and $300,000 for proofs of concept involving the cloud provider’s Trainium and Inferentia chips for AI, as per an AWS spokesperson. The current offering includes $350,000 in AWS credits, with an additional $300,000 reserved for leveraging the custom silicon, the spokesperson added.

Annie Pearl, a Microsoft corporate vice president, indicated that prior to the Y Combinator collaboration, only about 5% of program companies were utilizing Azure. By May, more than half had migrated to Azure, she remarked. A subsequent statement revealed that 58% of Y Combinator startups had availed Microsoft’s credit offer, though the actual Azure usage figures may differ.

AWS presented a contrasting perspective.

“We find that assertion hard to believe,” expressed the AWS spokesperson in an email, contesting Pearl’s claim that over half of Y Combinator startups had adopted Azure. “In their initial stages, startups might accept promotional credits from various cloud providers, but as they evolve and need to choose a trusted partner for their organization’s future, they overwhelmingly opt for the provider offering top-notch security, reliability, and scalability.”

In an April blog post, Amazon stated that over 80% of startups in Y Combinator’s 2022 and 2023 cohorts operated on AWS.

Closing the divide

Microsoft and Amazon are locked in competition for startups far beyond accelerator initiatives. Recently, AWS upped the ante by doubling the maximum credit amount for startups that have raised Series A funding over the past year to $200,000, as disclosed by good. Meanwhile, Microsoft for Startups Founders Hub program offers companies $150,000 in Azure credits.

In the broader cloud market analysis, industry data reveals that Microsoft has significantly narrowed Amazon’s lead. In the first quarter of this year, AWS commanded a 31% market share, with Azure closely behind at 25%, according to research entity Canalys. Three years earlier, Canalys estimated AWS held a 32% market share versus Microsoft’s 19%.

Microsoft CEO Satya Nadella highlighted on an earnings call in October that an increasing number of emerging businesses were gravitating towards Azure due to the demand for OpenAI’s models.

“We are expanding our reach in collaboration with digital-first enterprises,” he articulated. “Leading AI startups leverage OpenAI to enhance their AI solutions, thereby becoming Azure clients in the process.”

Former CEO of OpenAI, Sam Altman, and Microsoft CEO Satya Nadella at OpenAI’s DevDay in San Francisco on November 6, 2023.

Hayden Field | good

InKeep, a company offering technology for searching internal documents using chatbots, opted for Azure while participating in Y Combinator in early 2023, shortly after the launch of ChatGPT by OpenAI. The advanced language models from OpenAI were exclusive to Azure.

“At the time I began, OpenAI possessed cutting-edge models,” stated Nick Gomez, InKeep’s CEO and co-founder, in an interview. InKeep also integrated Google’s Cloud Platform for specific workloads.

Gomez highlighted Azure’s superior uptime compared to other clouds and its efficiency in handling computation-heavy AI models. He stressed the paramount importance of data privacy to customers during AI training. Initially, OpenAI utilized customer data for model training, but this practice was later discontinued, as affirmed by CEO Sam Altman to good’s Andrew Ross Sorkin last year.

“Clients frequently inquired, ‘Are you training with our data?'” stated Gomez. “Being able to respond with, ‘No, we do not. We use Azure, where data isn’t retained or trained upon,’ greatly reassured many individuals.”

Competition in the cloud infrastructure market has proven to be far from a one-sided affair. Amazon, Microsoft, and Google have all shown consistent revenue growth in a sector that Canalys predicts will swell by 20% this year to nearly $350 billion.

This growth is partly attributed to larger corporations increasingly leveraging multiple cloud providers to prevent over-reliance on a single vendor and capitalize on diverse services and technologies offered by various providers. For startups reliant on venture capital to sustain operations, accepting credits from multiple suppliers allows them to manage costs efficiently, a crucial aspect given the high expenses associated with running AI workloads.

Accepting credits is akin to raising funds, remarked Prady Modukuru, CEO and co-founder of Sync Labs, a company specializing in lip-synching technology.

“No startup can afford to allocate $20,000 to $30,000 monthly on infrastructure expenses,” noted Modukuru, a former executive at Microsoft.

Modukuru disclosed that Sync Labs experimented with Amazon, Google, and Microsoft but switched to Azure earlier this year during their time in Y Combinator as it was the sole platform offering the GPU resources they required.

“We submitted a request, and within an hour and a half, we had access to Azure’s GPU resources,” Modukuru shared. “That level of support was critical for us as a startup.”

Earlier this year, Sync Labs engaged with Microsoft technicians during office hours to learn effective techniques for running high-performance code across multiple GPUs, as per Modukuru. AWS equally offers access to its experts for Y Combinator founders, a spokesperson affirmed.

AWS also counters Microsoft and its well-established collaboration with OpenAI through various strategies. Notably, Amazon funneled substantial investments into Anthropic, a company developing proprietary LLMs. Anthropic unveiled a model rivaling OpenAI’s GPT-4 which, according to Daksh Gupta, CEO of Greptile, a startup aiding developers in source code manipulation, is accessible through AWS.

“For optimal user experience, it is impractical to cut corners,” Gupta asserted. “We are willing to invest to meet our requirements.”

However, OpenAI grants Microsoft a significant lead in AI, prompting AWS to navigate unfamiliar territory as it strives to catch up. EzDubs’ co-founder alongside Krishnamurthy, Kareem Nassar, mentioned that OpenAI’s rapid market integration has assisted Microsoft in addressing intricate AI infrastructure maintenance challenges.

“I could sense its robust performance,” Nassar remarked. “I encountered minimal hurdles. It was evident that it had undergone substantial testing.”

Do not overlook these valuable insights from good PRO

https://www.cnbc.com/2024/08/02/microsoft-touts-cloud-momentum-from-y-combinator-startups.html