Chipmaking giant Nvidia has entered “correction territory,” with shares now down 10% from all-time highs. The company, known for its graphics processing units (GPUs), has thrived in the artificial intelligence boom, which significantly increased the demand for its chips. Nvidia GPUs are widely used for compute-intensive AI applications such as OpenAI’s ChatGPT AI chatbot, and its server chips are crucial components in data centers.

In the past year, Nvidia’s financial performance has been remarkable, with a 486% surge in non-GAAP earnings per diluted share reported in the December quarter. The surge was driven by the high demand for chips, particularly due to the popularity of generative AI models. However, the stock has faced pressure recently, dropping 10% from its last all-time high close of $950 per share on March 25. It closed at $853.54 on Tuesday, down 2% for the session and 10% from its peak.

Definitions on market corrections vary, but typically, a correction is seen as a sustained decline of 10% or more from the high point.

What’s the reason for the move?

The specific reason for Nvidia’s stock decline is not immediately clear. One possible explanation is profit-taking by investors after a significant gain of over 200% in the past year. Additionally, on Tuesday, rival chipmaker Intel announced a new AI chip named Gaudi 3, designed for powering large language models, essential for generative AI tools like OpenAI’s ChatGPT. Intel claimed that this chip is more than twice as power-efficient as Nvidia’s H100 GPU and can run AI models 1.5 times faster.

Analysts at D.A. Davidson foresee a potential decrease in demand for Nvidia’s stock due to factors such as a shift to smaller AI models like Mistral’s Large and Meta’s LLaMA model. They predict that these trends could lead to a downturn by 2026, despite an anticipated strong performance by Nvidia in 2024 and 2025.

The analysts stated, “A combination of shrinking models, steady demand growth, maturing hyperscaler investments, and increased reliance by major customers on their own chips may not be favorable for Nvidia’s future performance.”

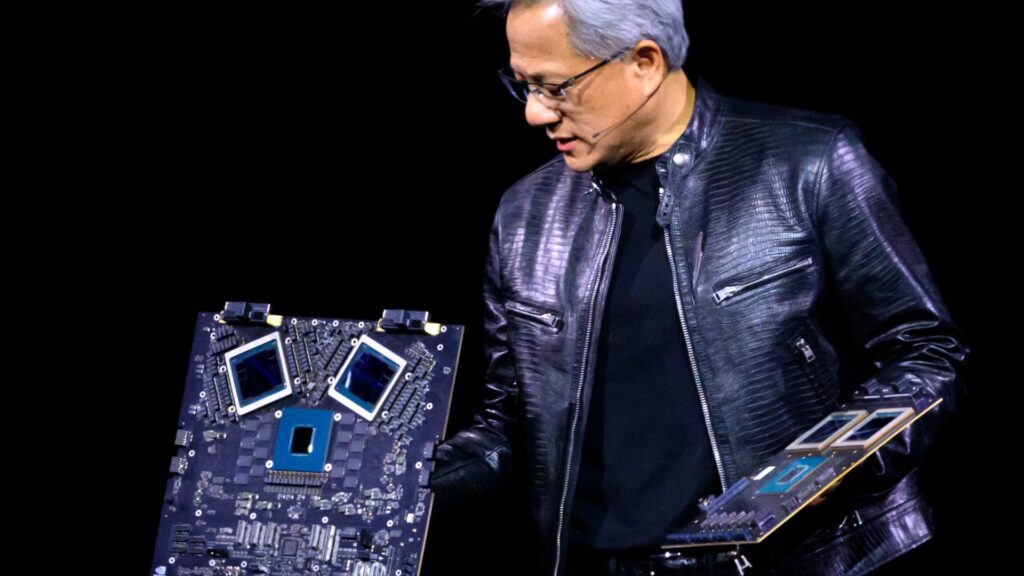

Nvidia founder and CEO Jensen Huang displays products onstage during the annual Nvidia GTC Conference at the SAP Center in San Jose, California, on March 18, 2024.

Josh Edelson | Afp | Getty Images

Shares of Nvidia are down 1% in U.S. premarket trading, indicating continued uncertainty among investors. The fluctuations in the stock price and market sentiment are essential factors to monitor, especially with the rapidly evolving landscape of the semiconductor industry.