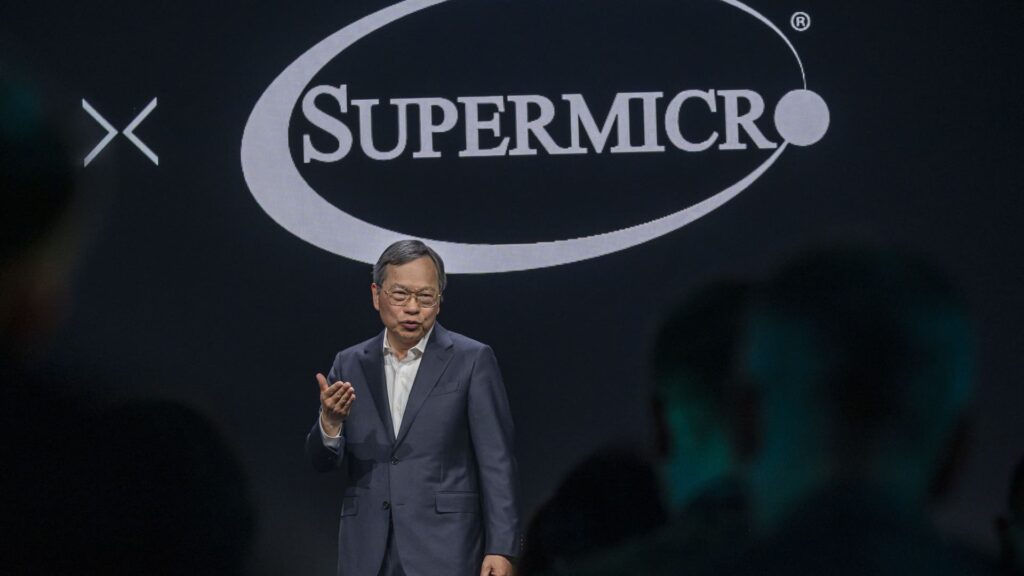

Super Micro Computer is expected to report its third-quarter earnings later this month, which has caused its stock to plummet significantly. Shares of Super Micro dropped 18% on Friday as investors opted to reduce their holdings in anticipation of the upcoming earnings report. Despite the recent decrease, Super Micro’s shares had seen a remarkable increase of about 168% this year, following a 246% climb in 2023. The company, a key provider of server and computer infrastructure, became a part of the S&P 500 in March. Super Micro has strong ties to Nvidia, a leading technology company that powers many of today’s sophisticated artificial intelligence models.

In a recent press release on Friday, Super Micro announced that it will disclose its fiscal third-quarter results on April 30. This marks a departure from the company’s usual practice of offering preliminary results. Notably, in January, Super Micro adjusted its sales and earnings forecast 11 days before revealing its second-quarter financials. The stock is currently experiencing one of its most significant declines since February 16, when it dropped by approximately 20% in a single day.

While Super Micro benefits greatly from its association with Nvidia, the market it operates in is fiercely competitive. Rivals such as Dell and Hewlett Packard Enterprise are in the process of developing systems utilizing Nvidia’s latest Blackwell graphics processing units. This competitive landscape poses challenges to Super Micro’s market dominance and requires the company to continue innovating and differentiating itself in order to maintain its position.

The stock’s performance will be closely watched as investors and analysts await the earnings report at the end of the month. The outcome of the report and the company’s future guidance will likely have a significant impact on Super Micro’s stock price and overall market perception. Observers will be looking for insights into the company’s financial health, growth projections, and competitive positioning within the industry.